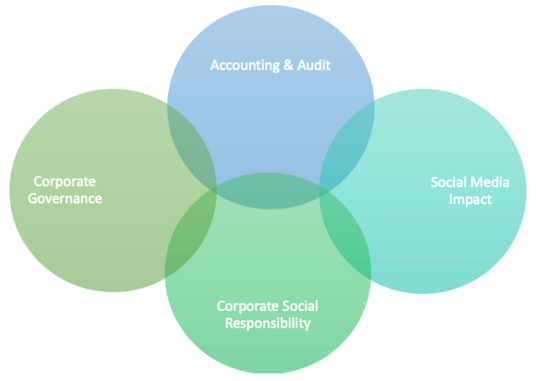

Research Focuses

The respective research foci of the professorship can be assigned to the four illustrated overarching topics of Accounting & Audit, Corporate Governance, Corporate Social Responsibility, and Social Media Impact.

Accounting & Audit

Driven by the internationalization of the capital markets, accounting systems such as IFRS and U.S. GAAP are increasingly determining German accounting practice. Since 2005, IFRS have been mandatory for all capital market-oriented European companies when preparing their consolidated financial statements. Some small and medium-sized enterprises also prepare their accounts (voluntarily) in accordance with IFRS in order to meet the information requirements of numerous shareholders and stakeholders and to ensure greater comparability with the annual financial statements of foreign companies.

Explicit consideration of the requirements and implications of international accounting is therefore an indispensable prerequisite for ensuring proper accounting practice. The differences between accounting according to national regulations and international standards are critically evaluated and examined with regard to their interdependencies with other areas of business administration. One of the aims is to critically and constructively accompany the further development of accounting from a scientific point of view. This requires a well-founded discussion of the core issues of individual regulations as well as a critical examination of existing accounting and disclosure rules. Here, explanatory approaches to the impact content (e.g. on capital markets, on important contractual partners such as banks, employee representatives, etc.) are developed.

Research questions can in particular also cover the legal framework of accounting. The application, interpretation, enforcement and review of accounting is regularly culturally influenced and thus subject to national legislation (especially company law, capital market law, tax law). Interdisciplinary research questions arise here, e.g., at the interface of economics and law.

External financial reporting is crucial for the functioning of markets. Confidence in these financial statements is in turn strengthened by auditing, which plays a central role in enforcing accounting that conforms to standards. The constant transformation of auditing practice through national and international regulation poses a major challenge to auditing practice and the corporate landscape. In this context, both normative and empirical research questions regarding the development, implementation and application of accounting standards are highlighted. Research projects also focus on the development of standards in the context of auditing.

Issues in the field of auditing and international accounting and their influence on the accounting quality and the capital market impact of companies are addressed in line with the investor relations approach, which focuses on the communication of information in line with objectives. In particular, regulatory changes, such as the discussion on the introduction of mandatory rotation at company level, are examined with regard to their effect on accounting quality.

Corporate Social Responsibility

Although the term Corporate Social Responsibility (CSR) is often used, the term sustainability has become established in the context of reporting. CSR can become a competitive advantage in that ecological and social efficiency also have an economic impact. Sustainable corporate actors align their activities with social, economic and ecological objectives. However, diverging stakeholder groups and their expectations prevent a uniform and intersubjectively comprehensible assessment of sustainability reports, especially with regard to performance relevance. This gives rise to requirements for assessment tools and challenges in regulatory and decision-theoretical terms.

Two factors in particular have decisively promoted international sustainability reporting: On the one hand, the work of the Global Reporting Initiative (GRI) , which presented the internationally recognized GRI Sustainability Reporting Guidelines (GRi G4). On the other hand, the increasing importance of environmentally responsible investments (SRI) and the corresponding indices such as the Dow Jones Sustainability Group Index. For this purpose, corresponding SRI rating agencies evaluate the performance of companies in the environmental and social areas. In doing so, they also rely on the sustainability reports published by the companies, among other things.

In the context of empirical research, the question arises as to the extent to which a joint sustainable corporate orientation has a positive effect on stakeholders, (non-)financial performance and risk management, and thus on risk minimization.

Social Media Impact

The introduction of social media such as Facebook or Twitter has significantly changed the way the world and people are connected. However, the growth of social media networks also has economic consequences, as many capital market-oriented companies have now recognized the possibility of these and thus maintain their own accounts. With the help of their own online presence on websites such as Facebook or Twitter, companies have the opportunity to get in touch with their stakeholders. However, since some of the companies' messages also explicitly concern their profitability per se, it can be assumed that communication on social media platforms could have an influence on the companies' share price developments. The Chair of International Accounting and Auditing is investigating in some empirical studies how significant the extent of influence is in reality.

The topic around corporate communication via digital channels is also investigated in the context of theses. In his current master thesis, Mr. Patrick Schönenberg links this topic with the reasearch topic of sustainability reporting. The question is whether companies actively use the possibility of interactive stakeholder communication regarding CSR information via Twitter and to what extent stakeholders react to CSR communication via Twitter.

Corporate Governance

The term "corporate governance" is understood as the legal and factual regulatory framework for good and responsible corporate management and control. The main topics of the professorship IRWP - accounting and auditing - are central components of this regulatory framework. The recent corporate scandals involving Wirecard and Volkswagen, for example, have once again brought this topic massively into the light of the public, legislators and researchers. As a result of the Wirecard scandal, the balance sheet control procedure was fundamentally reformed by the Financial Market Integrity Strengthening Act (FISG). As a result, corporate governance is also facing considerable changes, which give rise to a wide range of research questions.

However, corporate scandals that bring corporate governance into focus do not only occur in the private sector. Examples of mismanagement and embezzlement can also be found time and again in the special areas of public companies and non-profit organisations (NPOs). Here, a striking disparity in research can be observed: While there are numerous empirical studies on various issues of corporate governance in the private sector, corporate governance in public companies and NPOs has remained virtually unexplored. However, it is precisely these two areas - public enterprises and NPOs - that have an enormous relevance for public services and are thus of interest to society as a whole. The professorship IRWP contributes with current research to a broader understanding of corporate governance also in the area of public enterprises and NPOs.